If you were asked to imagine a public library, your mind would conjure up a familiar image: a giant room with books crammed onto every wall and shelf; patrons quietly reading at tables; a librarian (pleasant but stern) who would help you find anything you need but wouldn’t hesitate to shush you at the slightest indication that your voice might raise above a whisper.

Perhaps these images were true during your childhood, but the library has changed. Though public libraries have always served as meeting places where people might gather for a book club or town hall, many are now full-fledged community centers where residents can not only borrow books and use computers, but also take part in programs that teach everything from life skills to job preparedness.

The Queens Public Library (which services the Queens borough of New York City) is a leader in this evolving space. The library’s 66 locations boast more than 87,500 programs. These include standards like story time and knitting workshops, but also branch out into wellness (you can do yoga in the library!) and classes that help community members navigate the road to citizenship. And all of these programs are available within a mile of where most people reside. “Wherever you live in Queens, there’s a branch near you,” says Ewa Kern Jedrychowska, the deputy communications director for the library.

One program that’s become overwhelmingly popular is “Ready, Set, Bank” (Listos, Clic, Avance), which the library offers in partnership with Capital One. Monique Hector, who manages programs with the library’s Job and Business Academy (JBA), says JBA realized there was a need for a class on managing money and using online banking during existing workshops which helped residents find jobs.

“We provide resume assistance, cover letter assistance, mock interviewing,” Hector says. “There’s also a technology portion where we teach everything from how to use a computer to Advanced Excel and Word and PowerPoint. What we noticed in 2017 was that when we’re working with individuals who are looking for employment, they also need help managing their money.”

Hector’s first focus was on helping people who were unemployed find a way to use their savings to create a sustainable lifestyle. But as classes progressed, JBA found there was another demographic they needed to reach: people, primarily Spanish-speakers with families, who worked hours that wouldn’t allow them to get to the bank during business hours but weren’t familiar with 24-hour online banking.

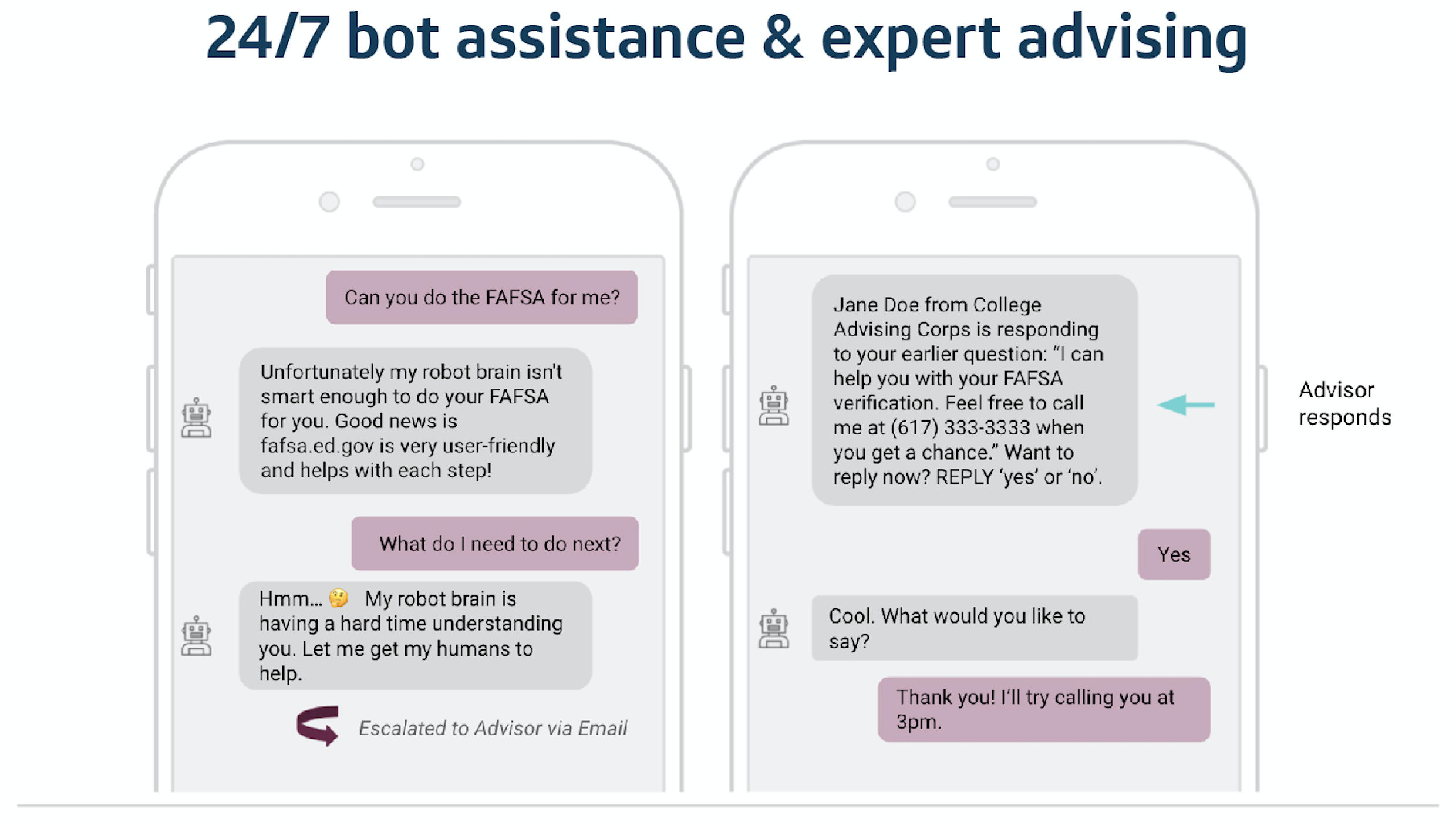

That’s where Ready, Set, Bank came in. The program teaches residents how to use banking apps, busts myths about privacy and security, and empowers community members to take control of their money by learning how to check balances, deposit checks, pay bills, and send money from their phones, thereby reducing both late payments and stress for people who are already working so hard. Sixty-three nonprofits and organizations use Capital One’s Ready, Set, Bank program across the country.

For Enelsida Maza, a Colombian woman who’s been living in the Arvene area of Queens for the past 13 years, the program has been life-changing. Maza goes to the library regularly to help her son pick out books and take computer classes offered in Spanish. When a librarian told Maza about Ready, Set, Bank, (Listos, Clic, Avance) she was hesitant at first because she always thought she had to complete all her banking in person.

“Now I can do my financial transactions wherever I am without losing time,” she says. “I don’t have to be late for work or take a day off to go to the bank.”

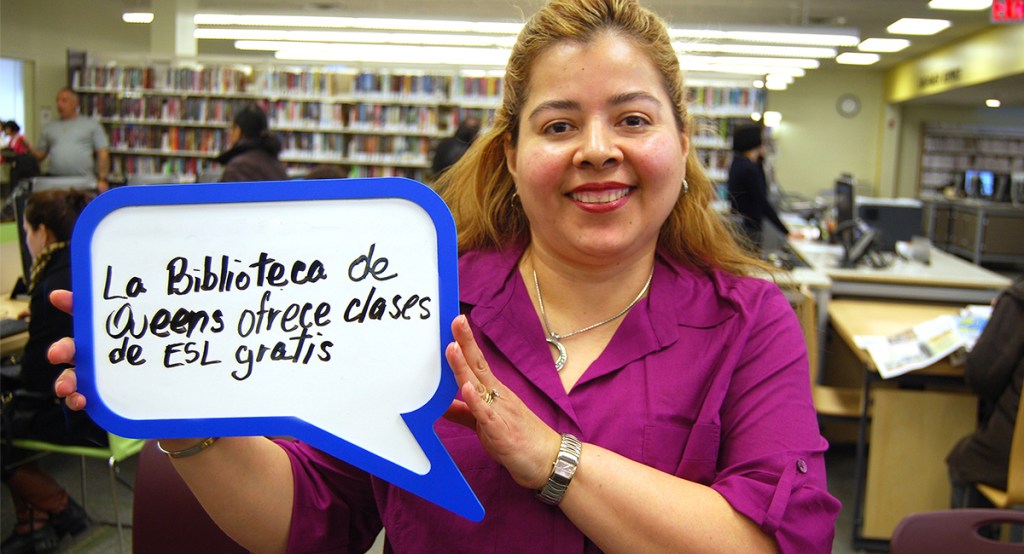

For Maza, one of the program’s biggest benefits is that it’s taught in Spanish. That’s been helpful for many participants, Hector says. Queens is considered to be America’s most diverse county and offering classes in languages other than English so no one has to feel uncomfortable or lost while trying to learn a new skill has brought in more and more participants.

An added benefit, Hector says, is that those taking the course will learn about the library’s other offerings at the same time. Many go on to take English for Speakers of Other Languages (ESOL) classes or avail the myriad other programs the library offers. For these people, the library becomes a safe space to learn and build community. Many participants, like Maza, bring in their friends and family members and they, in turn, bring their families, helping both the program and financial literacy grow.

The program is provided by Capital One. It’s unbranded, meaning there’s no pressure to sign up with or switch over to the banking institution — the organization simply wants to help people become more knowledgeable and empowered when it comes to their finances. That’s why community involvement has always been a cornerstone of the company’s ethos.

To help Ready, Set, Bank be as successful as possible, Capital One sends Financial Access Educators to help lead the workshops and provide feedback and insight. One employee, Hector says, jumped in and taught a few classes, staying behind to answer questions from participants and provide even more knowledge. In some neighborhoods, bankers have come in to talk to participants about how to best manage their finances. Since 2017, Capital One has provided financial support to keep the program going and expand it to as many branches as possible.

In response to the overwhelming positive feedback, the library is planning to add CreditWise — a workshop that deals with the ins and outs of holding a credit card — to its offerings soon. Hector hopes it will empower even more people to feel confident about their finances and pass on their knowledge to future generations.

To learn more about the Capital One’s Ready, Set, Bank program, visit www.readysetbank.org.

Information about Queens Public Library and its programs can be found at queenslibrary.org.