As an Amazon Associate, Upworthy may earn proceeds from items purchased that are linked to this article, at no additional cost to you.

Let me start by saying that young adults these days absolutely do have economics stacked against them. There’s no question that stagnant wages, the unaffordability of housing, outrageous college costs, post-pandemic inflation and good ol’ American corporate greed have all combined to create a tough financial reality for us all, but particularly for the millennials and Gen Zers who are starting off their adult lives feeling already underwater.

If you’re in that boat, allow a Gen X auntie to give you some sage advice. Absolutely, rail against the man and shake your fist at the skyscrapers and vent on TikTok if it makes you feel better. But also, none of that is going to change super soon, so you’ve got to own what you actually have control over, and that’s managing the money that you do have (however little it may be).

When my kids were little back in the early 2000s, my husband and I were living on one not-at-all-amazing income. I had been raised quite frugally, so I was comfortable penny-pinching as needed, but I was looking for more creative ways to stretch our dollars.

I had no idea how much one book would change my entire view of saving money—or how much money it would actually save me over the years.

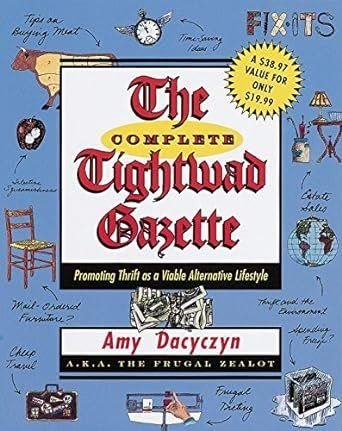

“The Complete Tightwad Gazette,” by Amy Dacyczyn (pronounced “decision”) is exactly what it sounds like—a newspaper for tightwads—only in this case “tightwad” isn’t used as an insult. From 1990 to 1996, Dacyczyn published a newsletter about frugal living as a lifestyle called “The Tightwad Gazette,” and this book is a compilation of her life’s work.

The book offers a combination of overarching mindset shifts and specific tips for saving money on specific things. Some of the advice is outdated now (“Do I really need a computer?” is a no-brainer question in a way that it wasn’t in the early 90s, for instance), but the principles underlying pretty much everything in the 959-page tome still ring true. Now that my kids are young adults with their own financial experiences, I find myself passing along a lot of Dacyczyn’s frugal wisdom to them.

Here are a few of the helpful bits of wisdom it contains:

1. Pennies matter a lot more than you think.

If I told you I was going to hand you $200 in cash every year on your birthday, you’d probably be thrilled. But if I gave you three pieces of advice that each saved you 20 cents a day, would you be as excited? Probably not. But the latter would actually put more money in your pocket (the equivalent of handing you $219 on your birthday) in the long run.

Lots of small amounts add up to a large amount, and when you wrap your head around that concept, small money-saving decisions start taking on greater importance. Pennies really do add up—both positively and negatively.

2. Think of saving money as income—literally.

“A penny saved is a penny earned” is an old saying, but a useful one to help us understand the value of going out of your way to save a few cents.

Let’s say your closest gas station sells gas for $4.39 a gallon. A station down the street, two minutes away, is selling it for $4.29 a gallon. To fill a 15-gallon tank would only cost $1.50 less at the second station—not even enough to buy a cup of coffee. Is that really worth your time?

Let’s calculate. If you think of saving money as earning income, you’re taking two minutes to “earn” $1.50. That’s $0.75 a minute—translate that into an hourly income, and you’ve earned the equivalent of $45 an hour, simply by driving two minutes to save 10 cents a gallon. Even accounting for the gas it took to drive a few extra blocks—less than 10 cents—you still come out with a hefty hourly wage.

This “time x money saved = hourly income” equation was a life-changing perspective shift for me. If it only takes a minute or two to save a dollar, that’s a solid hourly earning.

3. Use the absolute smallest amount necessary to do the job.

This is simple common sense when you say it out loud, but most of us don’t live this way in reality. We use more than we need of most consumable things most of the time, simply out of habit. When you pull out that string of floss, so it wraps around your fingers four times? What if you pulled out less and only wrapped it three or two times?

Start by cutting the consumables you use on a daily basis back by half—everything from toothpaste to dish soap to shampoo to toilet paper. We all get excited about 50% off sales, when we could easily save 50% ourselves simply by using less of the things we use all the time, with the same result. If you need to add a little back in after cutting back by half, go for it. But you might be surprised by how little you need to actually get the job done.

4. Do the math to determine what’s actually cheap and expensive to eat.

Even with the cost of groceries being ridiculously high, cooking from scratch is, in most cases, drastically cheaper than eating out or getting takeout.

I know the old folks like to tease you about your affinity for avocado toast, but it’s pretty eye-opening to compare the cost of buying something like avocado toast out and making it yourself at home. With current prices at my local grocery store, it would cost less than $1.00 to make avocado toast at home, and that’s even with good bread and a generous serving of butter and yummy seasonings. Add another 30 cents, and you can slap an organic fried egg on top. We’re talking $1.30 tops for super bougie breakfast toast at home.

But even within the “cooking at home” category, some meals are way, way less expensive than others. One of my favorite Tightwad Gazette investigations focused on how much various kinds of breakfasts cost per serving. Personally, I’m a huge cold cereal fan, which is bad news because it’s actually one of the most expensive breakfasts you can eat. Toast and eggs is (generally) cheaper. Pancakes are even cheaper, especially if you make them from scratch and not a mix. Oatmeal is super cheap. Oatmeal bought in bulk? Even cheaper. And the differences can be significant—again, looking at my current grocery store app, a serving of Cheerios costs 300% more than a serving of quick oats.

All of those choices add up, both positively and negatively. By doing the math, figuring out per-serving costs and choosing less expensive meals, you can cut your grocery bill by a lot.

This is just barely scratching the tip of the iceberg—there are so many tips and tricks for saving both small and large amounts of money. Since the economy isn’t going to be any kinder to us in the near future, learning how to make the most of what we do have is the best way to help ourselves. Find “The Complete Tightwad Gazette” here (or, in true tightwad fashion, at your local library, but it’s a good one to keep on hand for reference). Highly, highly recommend.