If you're like most people, you probably know it's hard to save money. Really hard. But do you know why?

Sure, we all know that one person who is really good at managing money and seems to have this whole saving thing figured out. But for the rest of us, storing all those "acorns" away for the winter is just tough. We all know it's important, but where — and how — do we even start?

First, know that you're not alone: Research shows that a lot of Americans don't have much in savings. One survey of about 5,700 people released by the Federal Reserve found that 46% of adults could not cover an emergency expense of $400 without selling something or borrowing money.

Image via iStock.

There are a number of reasons why getting in the habit of saving is challenging.

One reason stems from our scarcity of attention, wrote Sendhil Mullainathan, professor of economics at Harvard University in an article on CNN Money. We are more likely to prioritize our immediate needs (say, a new phone) over our future needs (such as our retirement).

This is similar to why we procrastinate in general. According to psychologists, we see our future selves as strangers. While we inevitably become them, the people who we will be in a few months (or decades) are unknown to us, so we do not always make good choices for our futures.

A second reason is that we tend to forget what it felt like during conditions of scarcity. So, maybe you used to survive on a smaller salary, but now that you are getting paid more, you are likely to also increase your spending along with it to buy more (or better) things.

Image via iStock.

Technology has also made it easier for people to spend more money. Paying for services or items is quick and easy today, especially as we move toward becoming a cashless society.

And on top of all this, there is peer pressure that can be applied via social media, said Sean Stein Smith, a CPA, CGMA, and assistant professor at Rutgers University-Camden. "Seeing pictures of celebrities, family, and friends posting their newest purchases during their most recent vacation can be a tremendously difficult hurdle to overcome," he explained.

So what can we do to become better savers? Here are few helpful tips and tricks to get you into the habit of saving:

1. Stick to a realistic budget and pay yourself — i.e., your savings account — first.

Image via iStock.

"In order to accomplish any goal, whether it is running a marathon or setting up a savings plan for yourself, you need to have a plan in place," says Smith, who is also a member of the AICPA's National CPA Financial Literacy Commission. To do this, you need to take the time to know where your money is going and how much you can afford to save.

Everyone’s circumstances are different, so it's important to make a realistic budget that includes all your bills and expenses. And budget your savings just like it’s any other bill that you are paying so that you're always contributing something to that savings account.

2. Make your savings payments automatic.

The same technologies that make spending so easy can make saving easy too. Try to automate the process as much as possible by setting up automatic payments on payday so that a chunk of every paycheck goes straight into your savings account and you don’t even have to think about it.

"It’s like jumping into a pool: You have to steel yourself to do it once, and you can benefit going forward," wrote Mullainathan, the Harvard economics professor.

3. Remind yourself what it’s like to be broke.

Since we forget what scarcity feels like as soon as we’re not experiencing it, one helpful thing can be to remind yourself of what it feels like to be broke when you do have money. FutureMe.org lets you write an email to yourself to be delivered later — on payday, for instance, when you'll forget how it felt to scrounge change together for groceries.

4. Take the 52-week money challenge.

Sometimes just getting started is hard, so why not take this 52-week money challenge to get yourself in the habit of saving? The challenge works like this: on week one, save just $1, then on week two, save $2, and on week three, save $3, and so on until you reach week 52, where you save $52. This incremental savings plan starts small, but it can add up to a big difference — you will save $1,378 in just one year.

Worried you won’t stick to the plan? Try the plan in reverse and start by saving $52 on week one so that you have no excuse on week 52 to not put that $1 in there.

5. Make a goal and stick to it, and celebrate milestones.

Image via iStock.

It’s important to have an emergency fund, but there are a lot of other things you can save for too. So while it's probably best to try to let your savings grow for a while (and keep withdrawals to a minimum), it's good to set smaller, more immediate, goals as well that allow you to reward yourself along the way with fun things, like that dream vacation you have always wanted.

Want to make sure your savings plan is realistic and well thought-out? Try the four-week financial fitness challenge.

6. Save your windfalls.

Did you get a larger-than-usual tax refund or an annual bonus this year? As tempting as it can be to rush out and spend it now, put that extra money into savings. You won’t miss the money, and it will get you closer to your savings goals.

7. Keep the cash back for your savings account.

Does your credit card or bank offer you cash back for certain purchases? Make sure to transfer those extra dollars right into your savings account.

8. Save your change.

Image via iStock.

Small amounts of money can go a long way too. Do you have a bunch of change rattling around in your wallet? Why not collect all those coins in an old-school piggy bank? When it is full, you can exchange the coins at your local bank or supermarket for cash that can easily be deposited into a savings account. It might not seem like much, but over the course of the year, those loose pennies can really add up.

Some banks also offer "keep the change" programs to automatically round up your debit card purchases to the nearest dollar and transfer the difference into your savings account.

9. Increase your savings contributions when and where you can.

Get a raise? Or did you finally pay off your mortgage or a credit card? Be sure to increase your savings contribution before you start spending to reflect your pay increase or extra money in the budget. It will help you get one step closer to your savings goals.

Image via iStock.

10. Get a budget buddy.

"Planning, automation, and sticking with it — think of it like a workout regime — are the 'secret sauce' to savings success," says Smith. And a great way to stick with it is to find someone, like your husband, wife, or partner, to help motivate you.

"[This is] someone that is on the same path as you that can keep you motivated, engaged, and committed when you are tempted to start slacking," he says.

For some of us, saving isn’t easy, but thankfully there are a lot of ways to trick yourself into getting better at it.

And once you develop the habit and start meeting your goals, your future self will thank you.

A

A

The 1940s were a time of great fear and consternation. But somehow people slept way better. Photo by

The 1940s were a time of great fear and consternation. But somehow people slept way better. Photo by

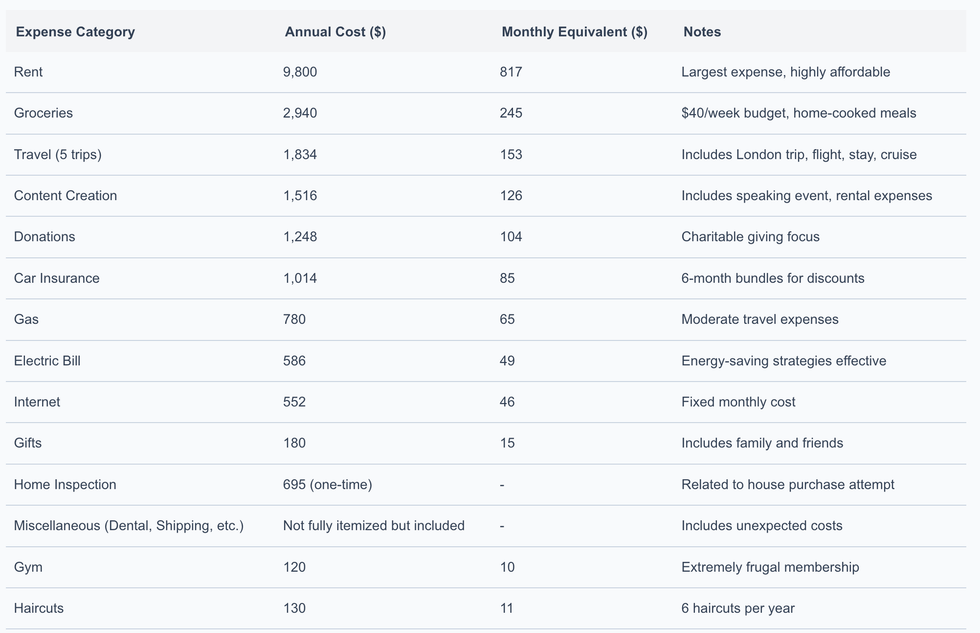

A breakdown of Bradley's annual expenses. Photo credit: Bing

A breakdown of Bradley's annual expenses. Photo credit: Bing