Talking about money is tricky business.

Think about it. Many of us share the most intimate details of our lives with friends and coworkers and even on social media. But money? That’s still as taboo as it’s ever been, and talking about it can get uncomfortable really quickly.

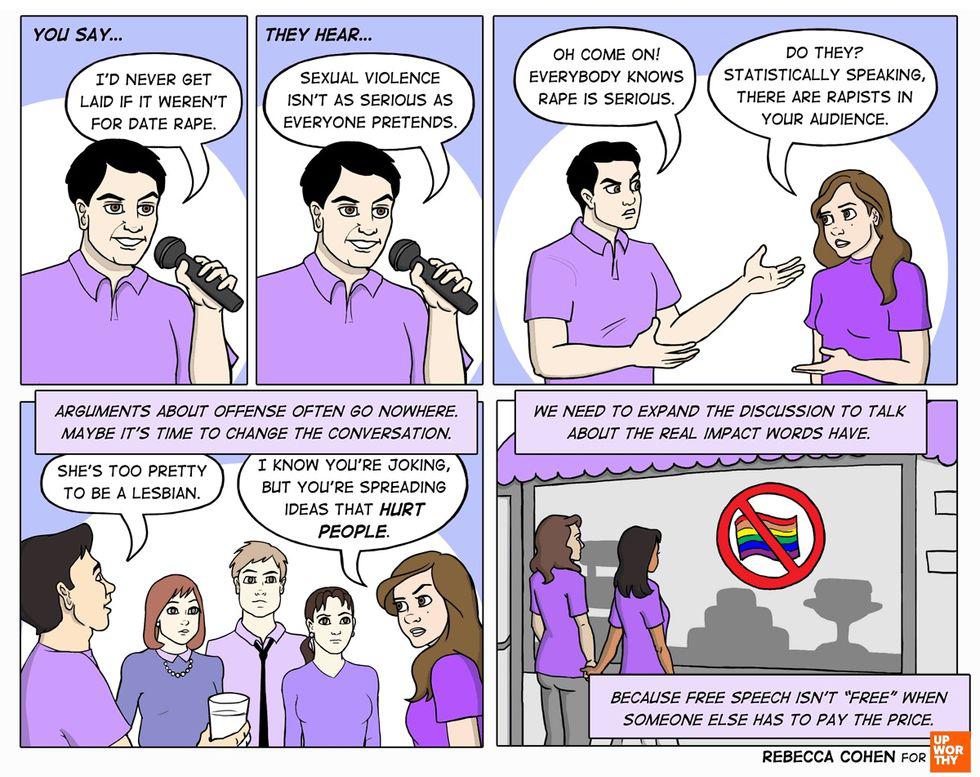

I know, right?! GIF via “Maleficent.”

That doesn’t change the fact, though, that there are important conversations many people need to have about money. Avoiding them can hurt our relationships and our financial health or those of our loved ones.

So where do you even start? And once you start, where do you go?

Whether you’re cleaning the house, going to the gym, or asking someone out, no doubt the act of simply getting started can be a tough one. Just imagine having to do that with the money talk!

Luckily, we’ve gathered some helpful tips to get you started on three essential money conversations: with your boss, your partner, and your kids.

Tip #1: How to ask your boss for a raise

Help them help you. GIF via “The Office.”

It may not seem super helpful, but the answer really is just ask (but be well-prepared, of course!).

Sounds easy enough. Yet for some reason, not many people do it. In a PayScale survey, 57% said they’ve never negotiated for a higher salary. We know it can be a scary thing to do, but you’ll never know unless you ask, right?

Luckily, the numbers are in your favor. According to another survey by PayScale, 75% of workers who asked for a raise actually got one. Which is awesome, but don’t forget to ask yourself an important question too: Why do you deserve the raise?

Once you answer that, you’ll have an easier time getting the ball rolling and will be much more confident sealing the deal.

Tip #2: How to talk to your partner about money

Don’t let it go here. GIF via “The Princess Bride.”

The answer: honestly.

Clearly, this is a given. But when it comes to money, sometimes we need a reminder.

In a 2014 survey, one 1 in 3 adults admitted to committing financial infidelity on their partner. And that can manifest itself in a variety of ways — whether it’s not being upfront about your spending habits, hiding your financial history, or just making secret purchases.

There’s a reason money is the #1 cause of stress in a relationship, and arguments about money are a big predictor of divorce. But it doesn’t have to be that way. By being honest at the onset and talking about money on a regular basis, couples can start a healthy dialogue that’ll give everyone a much better grasp of how to deal with finances down the road.

Tip #3: How to teach your kids about money

This is clearly what NOT to do. GIF via “Black-ish.”

The answer: WITH GAMES!

Money and math are rarely the most exciting topics for kids. And that’s where playing games comes in! Susan Beacham, CEO of Money Savvy Generation, tells U.S. News, “Games become something you can use to open the discussion, so it’s not always you preaching about money.”

You can try a classic board game like Monopoly. Or download a fun educational app for them. Or even pretend to be a customer in your kid’s make-believe store. The important thing is that kids learn the nuances of what’s going on each step of the way, so that they become familiar with financial literacy early on.

It can be intimidating to talk about money, but there are ways to make it a little easier.

Taking that first step can be challenging, especially in this area, but having a plan of attack certainly eases the burden. Now that you have some starting points, the next step is to do just that — start!