Like many people, Dana Nielsen had spent much of her life struggling with her relationship with money. “It was this object way outside of me that I didn’t have control over,” she says. “It was something that I needed but didn’t value. And I didn’t know how to have a relationship with something that I needed but didn’t value.”

Little did Nielsen know that exploring her relationship with money, figuring out what mental or behavioral obstacles were getting in her way, and forming a plan of action would give her power over her finances for the first time. But that’s how she felt after three Money Coaching sessions in a Capital One Café—empowered.

“It gave me confidence,” she says. “It gave me trust in myself and trust in money in a way that I had not had in the past. It really connected the dots for me.”

Nielsen was just launching her own private psychotherapy practice when she decided to try out the Money Coaching program. She says she was surprised by what it felt like when she arrived at the Capital One Café in San Francisco.

“It was a really different experience of being in a bank than I had had in the past,” said Nielsen. “Very calm and casual.”

Instead of a sterile atmosphere, Capital One Cafés feel like cool coffee shops, complete with cozy nooks, quality coffee, free WiFi and good lighting. Nielsen was offered a beverage, then her Money Coach invited her to a private space to chat about her goals and values, and how to use money to create a life she would love.

The Money Coach didn’t tell Nielsen much to contribute to her 401K or which stocks she should buy. Instead, the coach helped her explore her beliefs and emotions around money, set financial goals, and make an action plan for reaching them. She left feeling empowered and confident about her finances in a way she never have before — and it didn’t cost her a dime.

Nielsen says she had a lot of limiting beliefs about money, and her Money Coaching sessions helped her have a more positive outlook. They allowed her to set a different bar for herself and to align herself with the belief that she could create abundance and have control over her financial life. And it was fun, she says. “I loved bringing play to something that has historically and culturally so dry and so serious. Making it into something personable that I could work with was just so encouraging.”

That change in mindset resulted in real-life change. Since completing her Money Coaching sessions, Nielsen has opened a high-interest savings account, paid off a private business loan, raised her fees, and adjusted her sliding scale spots. She has also become more purposeful about where she chooses to spend her money, focusing on conscious brands and supporting more minority-run businesses, to align her spending with her values.

Now Nielsen recommends Money Coaching to people on a regular basis.

“Money is a foundational issue for a lot of people,” says Nielsen. “It’s in the same kind of belief categories as our sense of safety, sense of belonging, sense of home.” She has clients who make a lot of money but also have a lot of debt, and their relationship with money is messy. “For clients and friends that have issues in that department,” she says, “I refer them to Money Coaching as a supplement to therapy.”

Similar Money Coaching experiences are happening in Capital One Cafés across the U.S., and the program is the brainchild of a team of Capital One creatives and financial advisers who set out to explore what kinds of financial services people really need.

Through their research, the team found that people of all ages and life stages struggle with financial anxiety. If people don’t look at their emotional relationship with money, it doesn’t matter what changes they make on paper. People’s financial success won’t budge if they don’t address the thoughts, beliefs, and patterns of behavior they have around money.

Mira Lathrop, a co-founder of the Money Coaching program, worked as a financial planner for ten years prior to collaborating on the program, helping people manage their money. That experience, along with a degree in psychology and her work as a certified life coach, made Lathrop the perfect person to help build what has become Capital One’s Money Coaching service.The team created the Money Coaching service to help people move from stress to confidence in their relationship with money. This “money journey” is a free service available to the public, even if you’re not a Capital One customer. Anyone can come in for three in-person sessions with a Money Coach at no cost and with no further commitment.

Here’s how it works:

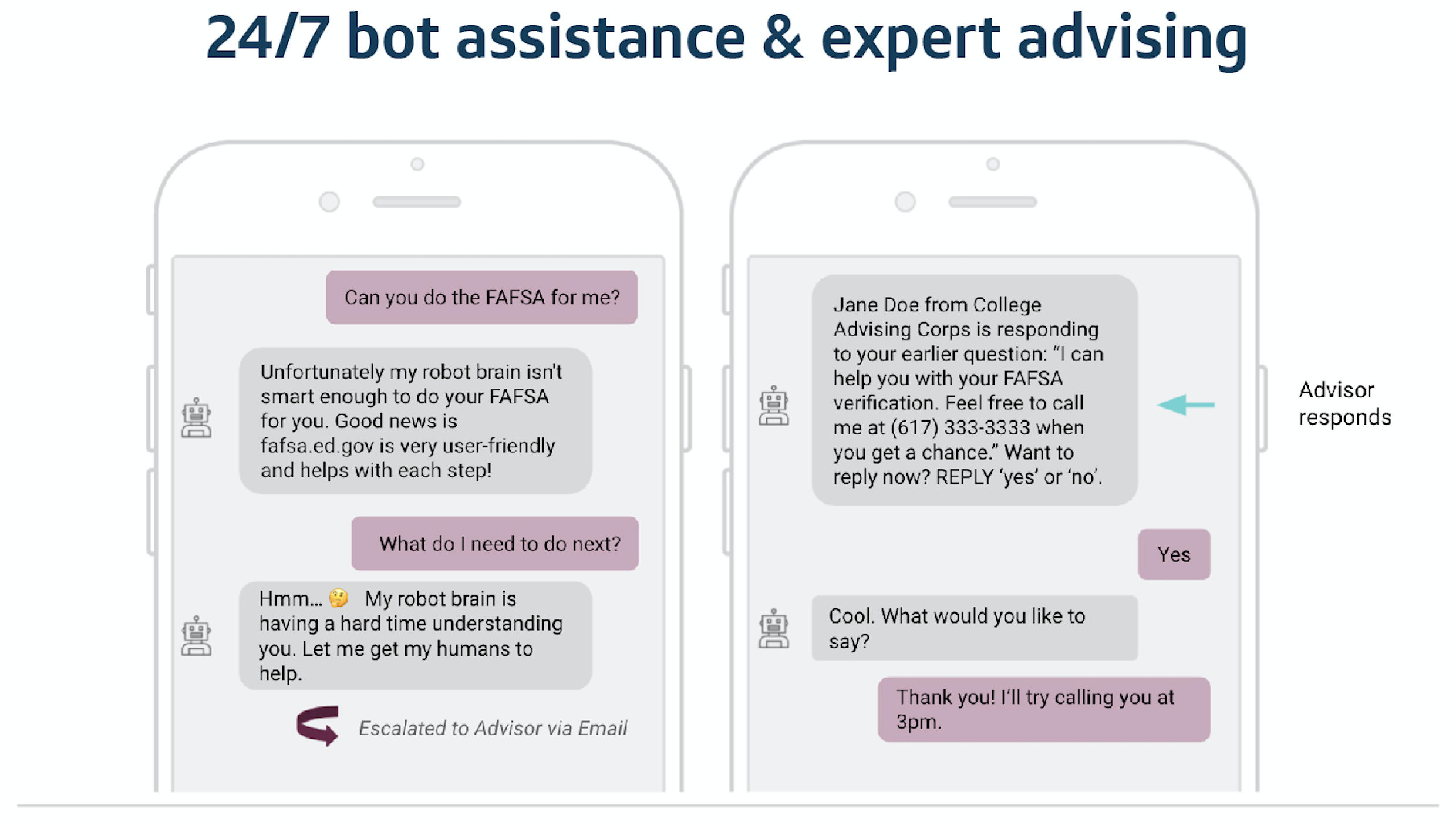

You set up a time to meet with a Money Coach at a Capital One Café near you. When you arrive for your appointment, an Ambassador in the Café will ask if you want something to drink, give you a tour of the Capital One space if you’d like, and then you meet your Money Coach — a certified coach who has been trained to help people work through beliefs and feelings about money.

You’ll be asked a series of open-ended questions and then the coach will help you choose from 10 tools the program has designed to help you discover an alternative perspective. The tools are interactive on an iPad, and include things like; Clear Your Path, Chart Your Values or Looking at your Future. The purpose is to help facilitate an honest, deep-dive into your hopes, fears, and goals — and ultimately leave you feeling empowered in your financial life.

“In coaching, we really believe that you are the driver of your life,” says Lathrop. “You know what’s best for you. Of course, there are answers that you might need to get, feedback you’d be interested in, and things you need to dive deeper in. But we’re facilitating a journey for you and walking alongside you, reminding you that you have access to what you need. You’re empowered to find out what’s the next best step for you.”

Lathrop says the most consistent feedback from people coming out of sessions is that it wasn’t at all what they were expecting, but they are “surprised and delighted” by the experience. People find having an authentic, honest conversation about money refreshing, which is exactly why Capital One designed the program.

“There’s a lot of financial advice available, but learning how to engage with money is not something we’re taught, she says. It’s not taught in school, and it’s not very comfortably talked about or taught in families.”

“I feel like this is such a rare and beautiful opportunity we’re offering,” she adds. “Everyone has a powerfully unique experience.”

To find a Capital One Café near you and make a free Money Coaching appointment, go to CapitalOne.com/MoneyCoaching.