The livelihoods of an estimated 24 million Americans — with real challenges and real families — are at stake with even the smallest of tweaks to the Affordable Care Act. Their stories deserve to be told.

Here are five of those powerful stories that show what’s at stake, should the Affordable Care Act be repealed.

Was he seeing his son for the last time?

“Something’s wrong with Noah.” I’ll never forget those words. My wife had said them, holding our rigid son in her arms, as we prepared to head out to the farmer’s market on a Saturday. Our 7-month-old’s lips and hands — so tiny and fragile — had turned blue.

We rushed him to our pediatrician. In the waiting room, Noah had a seizure. They told us to go to the emergency room immediately, so we sped across town. There, he began seizing again. As they were finally taking him to his own room — we’d been waiting 20 minutes for a bed — Noah had the most violent episode yet. They administered emergency meds in the elevator. I remember seeing his eyes roll back in his head. It was horrifying.

Photo courtesy of Geoff Todd.

That was the day Noah was diagnosed with pediatric epilepsy. It came out of nowhere. Everything had been picture-perfect up until then. ICU stays and ambulance trips became increasingly normal, as we struggled to pinpoint which prescriptions would make the seizures stop. I’ve watched our son on a ventilator, wondering whether or not I was seeing him for the last time.

Things took a big turn for the worse when Noah was 5: I lost my job and the insurance that came with it. I found a new job, fortunately, but the insurance provider denied coverage for Noah. He had “pre-existing conditions,” they argued and disqualified him from care.

We began drowning in debt from the medical expenses. We almost lost our home. It felt like every single penny went toward making sure Noah was going to be OK. Should we give him medicine or food? That question haunted us. People say, “Well, you can go out and get a second job,” but really, you can’t — not when your son requires that level of around-the-clock care. I’m not exaggerating when I say my wife and I haven’t taken a vacation together in the past 10 years.

Photo courtesy of Geoff Todd.

In 2011, we found relief: Noah was covered under the Affordable Care Act’s Medicaid expansion in Oregon. It felt like coming up for air for the first time in years.

It felt like a chance to exhale.

Now Noah, who turns 10 in August, has the care he needs. Paying for his medications and therapies (kids with autism can need a lot of extra attention) are much more manageable. He’s had two major surgeries too, and I have no idea how we possibly could have footed the bill, had it not been for Obamacare.

— Geoff Todd, as told to Robbie Couch

They lived in fear, wondering if they’d lose their daughter.

Two years ago, my daughter Caroline, 18 months at the time, had a visit to the pediatrician to clear up persistent ear infections. During the checkup, the doctor heard a heart murmur; her heart was enlarged and working too hard. Our pediatrician sent us to a cardiologist who gave Caroline an echo, kind of like a sonogram of the heart. That day, she was diagnosed with idiopathic pulmonary arterial hypertension. It’s incredibly rare.

Caroline is truly one in a million.

Photo by Collin Ritchie, via Kristi Hammatt.

When Caroline was first diagnosed, we lived in fear, wondering if we’d lose her. We’d celebrate each birthday and milestone like it might be our last.

There’s no cure for Caroline, but there is a life-saving drug that’s reversed many of her symptoms. It’s called Remodulin, and Caroline receives a 24/7 infusion of the drug thanks to a backpack with a small pump inside. And, yes, it’s truly 24/7. She wears the backpack to sleep, to dance class, in the bathtub, even to swim with her friends.

Drugs like Remodulin that treat such rare diseases have little chance to be profitable, which means pharmaceutical companies offer them at exorbitant prices. Caroline’s Remodulin protocol is $200,000 a year. There are no competitors and no generic version. This is our only option.

Luckily, we have health insurance through my husband’s employer. When we tell people we pay a $6,000 deductible, and we meet it on Jan. 1, they nearly pass out. But it beats the $200,000 alternative.

Now, we have hope. We’re confident Caroline will dance in her June recital. We’re confident she’ll start pre-K this fall. And we have a drug, a very expensive drug, to thank. While we don’t have insurance from the marketplace, we are wholly invested in preserving the Affordable Care Act.

Before the ACA was established, many insurance plans had yearly and lifetime caps. If these caps return, our family will likely hit the lifetime limits of a premium plan within four to five years. My husband would have to find a new position and a new insurance carrier, or we would lose everything to save our little girl.

My family stands with every man, woman, or child who has looked a disease in the face and told it, “I WILL WIN!”

I won’t go back to living in fear. It’s time to fight. I’m considering a House or Senate run as early as 2018. It’s not always easy for me to be an advocate like this, but it’s my duty to speak out and support affordable, comprehensive care — not just for my daughter, but for everyone.

— Kristi Hammatt, as told to Erin Canty

She still wonders if she’ll get to watch her kids grow up.

Even after two “clean” mammograms and an inconclusive ultrasound, I knew something wasn’t right. Thankfully, my radiologist was persistent. Three days after Christmas, she performed a biopsy. I asked her during the procedure, “Be honest with me. How concerned are you?”

She didn’t hesitate. “I’m very concerned. There is a type of breast cancer called invasive lobular carcinoma. It’s sneaky because on mammograms, it just looks like dense breast tissue.” She did the biopsy and the next day I got the call — breast cancer.

The active phase of my treatment felt like a lifetime. My tumor was nearly the size of my entire breast. I had 16 rounds of chemotherapy, then underwent a bilateral mastectomy, suffered multiple infections, followed by 33 rounds of radiation. Last fall, I started a six-month course of oral chemotherapy, which I’m about to complete. Soon, I’ll require daily tamoxifen or some type of hormone-blocking therapy for at least the next 10 years to minimize my chances of the cancer coming back.

Photo by Laurie Merges, used with permission.

As scary as cancer is, I was one quick decision away from a very different outcome.

Months before my diagnosis, I was laid off. As a single mom, all three of my children were on the health insurance plan I had through my employer. I was especially concerned how the interruption in care would affect my son. He’s on the autism spectrum, and while he’s considered “high functioning,” I wanted to continue things like his behavioral therapy.

I applied for Medicaid for my kids and learned I was eligible as well — thanks to the Medicaid expansion in Ohio made possible by the Affordable Care Act. While I’ve always been pretty healthy, I signed up as a safety net until I found another job.

That decision literally saved my life. Today, I’m classified as “no evidence of disease.” It’s great, but I’m not out of the woods.

When the conversation about repealing the Affordable Care Act began, I was scared out of my mind. I worried about my current treatment; as a cancer survivor, I now have a pre-existing condition. Would I be able to get coverage again? Not to mention my son who has a pre-existing condition with his autism diagnosis. What about his future?

Sometimes I look at my children and wonder if I’ll get to watch them grow up. My fiancee and I are starting a life together. How much time will I have with her? There are so many question marks.

This experience has turned me into an accidental activist. It’s frustrating to hear politicians talk about Medicaid like it’s a bunch of people who are lazy or don’t want to work. In reality, they’re trying to get by and doing the best they can.

— Laurie Merges, as told to Erin Canty

Warning: The following story discusses suicidal thoughts and feelings.

She used to think about jumping on the subway tracks every day.

Photo courtesy of Lydia Makepeace.

It’s tough to think about it now, but I had plans to jump onto the subway tracks and end it all. I used the train all the time back in 2009, while I was living in New York City, and the temptation was always there. My therapist would make me sign a contract agreeing not to die by suicide before our next meeting every time I went to see her (just to give you an idea of where I was at).

I live with bipolar disorder and depression. It’s affected basically every aspect of my life: relationships, my grades in school, my ability to find (and keep) a job. I would get everything together, finally feeling as though I’m on top of it, then it’d all come crashing down overnight. My momentum, so to speak, would keep stalling.

I couldn’t get the right health care I needed. My mental illness meant I had a “pre-exiting condition,” after all, and before the Affordable Care Act, it was perfectly legal for insurers to slam their doors in my face because of it. While a charity helped cover some costs for therapy, I was paying out-of-pocket for my meds. It wasn’t cheap.

March 2009 was like living through a perfect storm, in a sense. I’d been recently diagnosed, my meds were actually exacerbating my problems, and I was drained from working two jobs and struggling to survive. I blamed myself for failing to stay in control.

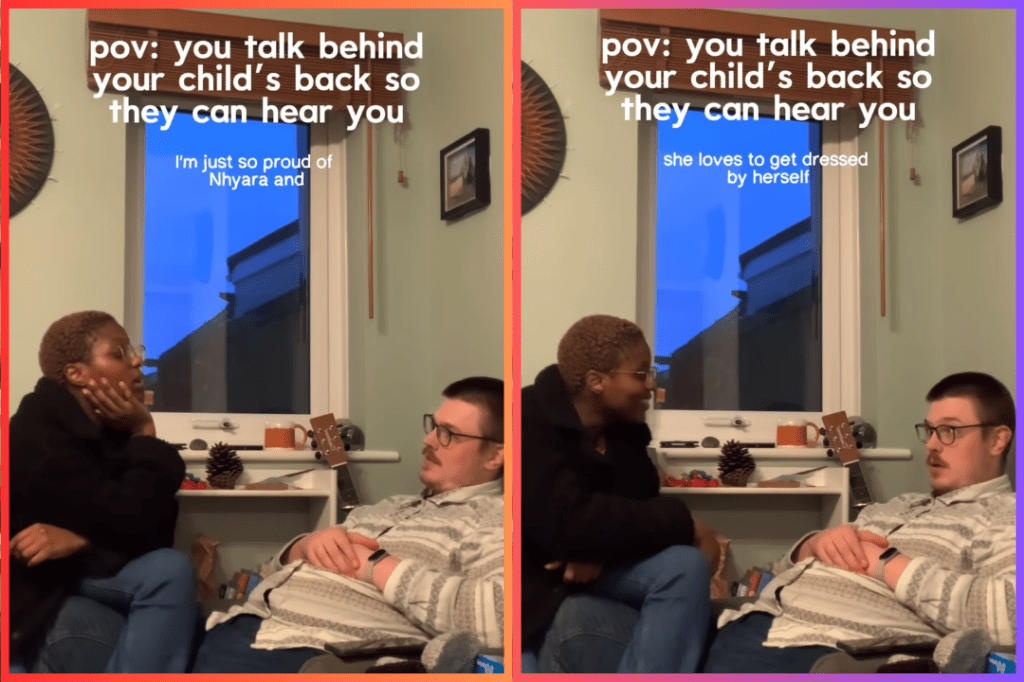

Lydia told her story about living with mental illness on YouTube in January 2017, showing viewers why the Affordable Care Act is important to her.

To save money, I’d skip some days or only buy my prescription when I could afford to. I was still figuring out which medications would work best for me, too, and a mood stabilizer I’d been taking had the opposite effect, making me even more manic. Everything felt so out of control.

I had people who refused to give up on me, though — myself included. I got married around that time to a great guy who cared about getting me help. I eventually gained health care through his employer’s insurance provider. Because of the ACA, they couldn’t deny me care for my pre-existing conditions. I cover co-pays for my medicine, of course, but it’s manageable. If the ACA is repealed, we’ll go backward when it comes to mental health care for people like me.

Now, I run my own business. I have the stability to follow through on projects. And I can build on that momentum I mentioned before in a way that wasn’t possible pre-ACA.

— Lydia Makepeace, as told to Robbie Couch

Getting a full-time job could potentially bankrupt him.

I have a vascular malformation in my brainstem that bled when I was young. Over time, it slowly affected my ability to walk. Six years ago, just before I was set to finish my graduate program at Yale, I underwent a treatment to try to stall or stop that progression, but ended up completely unable to walk. It wasn’t a sudden disability, as I’ve always been afflicted with it, but until that moment, I’d lived a pretty “normal” life.

Now I have a permanent disability and rely on a wheelchair for mobility. I can’t drive, so any time I have to go somewhere, I have to arrange for somebody to help me or I have to go through public transit, which can also be tricky. Each day requires more planning than it used to.

John T. Image used with permission.

I can only can work so many hours in a day, so I have two part-time jobs. I teach at a local university and tutor chemistry out of my home. Neither of my jobs provides benefits, but because of my income, I take part in Medi-Cal, California’s Medicaid program. California is one of the 32 states that expanded Medicaid coverage as part of the Affordable Care Act.

The uncertainty is really scary.

When it comes to the future, I find myself between a rock and a hard place. I would like to seek full-time employment — hopefully with good insurance through my employer. But if the position was temporary (as many teaching positions are) or if my health prevents me from making full-time work, I would be out of a job, off Medicaid, and without health insurance. Without the Affordable Care Act, I may not be able to afford high premiums out in the market. Making too much money or getting a full-time job could potentially bankrupt me.

I wonder if it’s even worth trying to go out and earn more or seek full-time employment. The risk of losing my current coverage is too great. I don’t think the creators of this bill intended to effectively trap someone in poverty with limited options, but that’s what’s happening.

From personal experience, I know health care is never cut-and-dried. But regardless of a person’s situation, no one’s ambition should be limited by the looming threat of an accident, illness, or medical condition. None of us voted for that.

— John T. as told to Erin Canty