'Bradley on a Budget' saved $200,001 in one year. Here are his 5 extreme frugal habits.

"Basically, I live in the dark."

Bradley, a content creator, saved nearly 90% of his annual income.

You know the feeling. That gut-punch moment when you open a credit card statement or check your loan balance and watch the number refuse to budge. For too many of us, debt doesn't feel like a problem to solve. It feels like a life sentence. But what if the answer isn't chipping away at it dollar by dollar? What if you burn the whole thing down and start over?

Meet Bradley, known online as "Bradley on a Budget." This content creator isn't just avoiding avocado toast or skipping oat milk lattes. He's turned frugality into an art form. A chilling, extreme performance art. In a recent video titled "How much money I saved living extremely frugally this year," Bradley revealed that he saved an astounding $201,369, roughly 85.9% of his total income.

- YouTube youtube.com

Sounds impossible, right? Well, yes. For starters, it means Bradley earned $234,479 in 2025. While his financial transparency is admirable, that level of income simply isn't a reality for most Americans. In 2025, the average individual income was $53,010, placing Bradley in roughly the top 4% of American earners. When you have the luxury of knowing there's money in the bank, living life to the extreme gets a whole lot easier.

Bradley's methods might sound extreme, but there's something worth paying attention to here. Through sheer discipline and a willingness to live differently than most people, he managed to save more than $200,000 in a single year. His approach won't work for everyone, and honestly, it probably shouldn't. Still, it proves an important point: you have more control over your money than you think.

Here's how Bradley did it, and the specific habits that helped him save nearly 90% of his income.

The moment that changed everything

Bradley's story didn't begin with an impressive income. It started in a place many of us know well: deep financial stress. After graduating from the Culinary Institute of America, he earned a prestigious degree and diploma, but he also inherited $130,000 in student loan debt. Out of the Institute, his first job paid $12 an hour.

"My student loan payment was almost half of my monthly income, and I had two choices: I could accept defeat and let this be my life forever, or I could make my situation better," he told People.

He chose the latter. Entering what he describes as "survival mode," Bradley stripped his life down to its barest essentials. There were no financial mentors or wealthy parents to bail him out. Instead, he decided that financial freedom was more valuable than his current comforts.

Years later, that survival mode has evolved into a lifestyle choice. In 2025, despite earning $234,000 from various income streams, he spent just $33,100 to live.

For context, the average American household spends about $6,545 per month, which comes out to approximately $78,535 per year. Of course, that figure reflects household income. If there are two earning adults in a household, that breaks down to about $3,272 per person each month, or $39,268 per year. That's still higher than Bradley's annual spending of $33,100, or about $2,758 per month. And if you could save even $500 a month, wouldn't you?

(For transparency, we're using half of the average household income to approximate individual income in the U.S., according to data from the U.S. Bureau of Labor Statistics.)

Step 1: A disciplined approach to groceries

Food is one of the biggest budget busters for families and individuals alike, with Americans spending about 13.7% of their total expenses on food and alcohol. For individuals, that's $5,406 per year, or $451 per month.

In total, Bradley spent just $2,940 on food in 2025.

Broken down, that's about $245 a month, or roughly $60 a week. How the heck does he manage that? A dinner at a nice restaurant can easily cost more than that per person.

The answer is simple. Bradley sticks to a strict routine, cooking all of his meals at home and eating the same simple meals every day. By eliminating variety, he reduces food waste and impulse spending. He knows exactly what he needs, buys only that, and eats every simple bite.

Isn't he a culinary school graduate? Yes. While his diet might seem dull to most, Bradley views it differently. For him, food is fuel, and money saved tastes better than any fancy restaurant meal. In fact, he avoids dining out altogether, calling it "expensive and stupid" if you're trying to save money as aggressively as he does.

Step 2: Car costs are kept to a bare minimum

Anyone who drives knows how quickly car expenses can pile up, from monthly payments and insurance to registration fees and the occasional ticket. Bradley sidesteps most of that by driving an older car he's already paid off and maintaining it carefully. In 2025, his total car-related costs, including oil changes, registration, and a taillight repair, came to just $264.

Insurance is a necessary evil, and Bradley paid $1,014 for the year, or about $85 a month. He notes that he saves money by choosing six-month bundles instead of paying monthly premiums. He also spent roughly $780 on gas. For comparison, the U.S. Energy Information Administration (EIA) estimates that the average individual spends about $2,148 on gas each year, or roughly $179 a month. Of course, that figure can vary widely depending on where you live.

@baddie.brad Crazy right? People think small purchases don’t matter when actually they add up to A LOT over time.

♬ Thrill of the Night (feat. Nile Rodgers) - Sébastien Tellier & Slayyyter & Nile Rodgers

In total, Bradley spent $2,058 on car-related costs. By driving a paid-off vehicle and using it only when necessary, he's able to keep his transportation expenses low.

Step 3: Traveling the world on a dime?

You might think someone who banks 90% of their income spends weekends in a dark room, eating beans straight from a can. But Bradley actually traveled quite a bit in 2025, taking five trips in total, including a week in London.

The shocker? He spent $1,854 across all five trips.

Pause. Reality check. In 2025, Bradley was also a certified social media superstar, a frugal influencer with 1.5 million followers on TikTok. Without a detailed breakdown of flights, accommodations, and daily expenses, it's hard to tell what was frugal traveling and what was a paid opportunity, like the speaking event he gave (where he was paid but booked the flight and accommodations out-of-pocket).

Bradley's travel advice is harder to scale than his grocery budget, but the principles still hold up. Book flights early or late, whenever the algorithm blinks. Travel in the off-season. Pack snacks. Stay in hostels, or at least skip the hotel minibar. It's not revolutionary, but it works.

It's a nice reminder that living within your means doesn't have to limit your lifestyle.

Step 4: Extreme utility savings

Here's where Bradley loses most people. To keep his annual electric bill under $600, about $49 a month, he lives like someone prepping for the end times, just without the stockpile of canned beans.

He unplugs everything when it's not in use—yes, even the refrigerator if he's leaving town for a while, contents and all. He washes his hair in the sink to avoid heating a full shower's worth of water. And he refuses to turn on the heat in winter or the air conditioning in summer.

"I think it's amazing," he said. "Basically, I live in the dark."

While this extreme "survival mode" isn't realistic for everyone, especially considering that Bradley lives alone, it underscores his dedication to achieving financial stability, even at the cost of his own physical comfort.

Other expenses

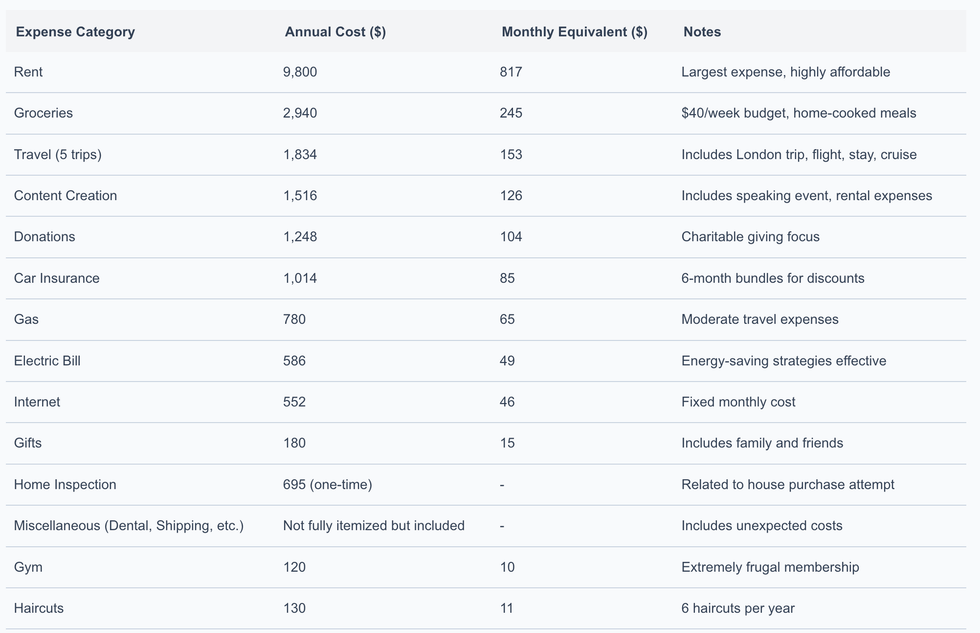

Let's fill out the rest of Bradley's expenses:

- Gym: His lowest annual expense was his gym membership, which cost just $120 for the year, or $10 a month, because he "refuses to pay more."

- Haircuts: Six throughout the year, totaling $130, or about $22 per cut.

- Internet: $552 per year, or $46 a month.

- Home inspection: "And I almost bought a house this year!" he shared. That home inspection cost him $695.

- Friends, fun, and dates: $567 per year, or about $47.25 a month, roughly $12 a week.

- Gift giving: A wonderful place to spend extra money. $1,080 for the year. Bradley shares that he bought his mom Coldplay tickets, paid for his sister to get her nails done, and replaced the fireplace doors in his mom's home for Christmas.

- Donations: "I started donating earlier this year to work on my relationship with money," he said. His donations totaled $1,248 for the year.

- Taxes: "I owed $8,219 in taxes for the 2024 season."

- Rent: Like most Americans, rent was Bradley's largest expense, totaling $9,800 for the year, or about $816 per month. That's a true achievement, considering he lives in New York City.

@baddie.brad Basically I go without until I can get it for free haha

♬ Morning Happy Melody - Donguri

Step 5: Side hustles and smart saving

Bradley's remarkable work ethic and commitment to his lifestyle may be his strongest attributes. Remember that top 4% income bracket? Bradley isn't just saving. He's hustling, too. He manages 10 diverse income streams, including content creation, brand partnerships, financial coaching, and more.

@baddie.brad I basically didn’t have a day off last year haha but the hard work paid off!

♬ Morning Happy Melody - Donguri

Despite his significant income, he avoids "lifestyle creep" by refusing to upgrade his apartment unnecessarily, buy a new car, or dine at luxury restaurants.

A quick analysis of Bradley's 2025 finances shows that his exceptionally high savings rate, roughly 86% of his income, reflects strong financial discipline and cost-effective management.

Rent, his biggest fixed expense, remains well below what he could afford, whether by careful design or by choosing to live somewhere most people wouldn't. The home inspection fee also suggests he's eyeing real estate and searching for smart investments.

The numbers tell the story plainly. Bradley keeps his fixed costs low, spends money only on what truly matters to him, and saves the rest. There's no fancy apartment, no new car, and no creep toward a more expensive lifestyle just because he can afford it. It's discipline, yes, but it's also strategy, the kind that builds wealth rather than merely earning it.

It's not deprivation. It's freedom.

It would be easy to dismiss Bradley's lifestyle, with its cold apartment and repetitive meals, as miserable. But Bradley genuinely believes the sacrifices are worth it, and he lights up when discussing his bank account.

"For me, 'treating myself' means watching my bank account grow," he said.

It's gratitude, plain and simple. When temptation hits, say in mid-July, when the apartment feels like a brick oven and the A/C unit sits there taunting him, he thinks back to what it felt like to be underwater. The sleepless nights. The pit in his stomach every time a bill arrived. The way debt made him feel small. Compared to that, a bowl of oatmeal tastes just fine.

Creating your own version of financial peace

Bradley knows his approach isn't for everyone. He's single, hyper-focused, and willing to live like a monk if it means hitting his financial goals. If he had a partner or kids, he admitted he'd dial it back. After all, no one wants to explain to their spouse why the refrigerator is unplugged again.

The takeaway here isn't about living in the dark or eating the same meal every day. It's about knowing exactly where your money goes. Bradley can pull up his spending down to the dollar because he tracks it. Most of us couldn't do that even if someone offered us a hundred bucks on the spot. We swipe, we tap, we subscribe, and we assume it'll all work out. It usually doesn't.

Start by questioning the expenses you've normalized. That gym membership you haven't used since February. The streaming service you forgot you had until the charge hit. The new car when your current one runs fine. Pick one category—groceries, transportation, housing, whatever bleeds the most—and get serious about it. Not miserable. Just deliberate.

You don't need to save 86% of your income or completely transform your life. But doesn't saving 10% or 20% of your earnings, and actually knowing where your money is going, sound nice?